Published on Feb 28, 2025

This project underlines the need and importance of the back office function in a share broking firm with special reference to its deployment in Pune Stock Exchange. Back office is the back bone of any broking business.

The main and important function of the back office is to ensure that the rules and regulations are strictly adhered to and the control is maintained on the operations of the firm. The success of the back office largely depends on the efficient functioning of the back office. It can be well understood by each and every broking firm that in order to gain a competitive edge and sustain the challenges of a dynamic environment today it must have a very efficient back office. This project tries to tell us that the why back office functioning is essential for every firm in this kind of business, so as to increase its profitability, efficiency and sustain the pressures posed by competition.

This project also tries to bring out the role of the personnel working in the back office, and how their efficiency and devotion plays an important role in the success of any broking firm. The project contents are followed by the objectives which will be followed by the introduction to the topic. Methodology adopted will help us to know how the project has been carried out. Observations and Findings will be followed by the suggestions to improve the efficiency of the back office function in Stock Exchange.

In order to retain investor confidence there are regulatory authorities like SEBI to regulate and control activities of capital market, But in order to achieve this precautions should be taken at the grass- root level that is at each broker s place. For obtaining this it becomes essential to have qualified personnel at the back office of each broker so that the back office function is carried out smoothly and In order to understand the process of back office function my objectives while undergoing project were

o To understand and know Back office function

o Importance of back office function

o Various ways and means by which efficiency in back offices can be improved.

Information to prepare this project report on back office function in a share broking firm was gathered through

o Discussion with the company project guide and college project guide.

o Information published in various publications, books, journals, web sites etc.

o Extensive discussions with senior level management personnel, some of them forming the part back office function.

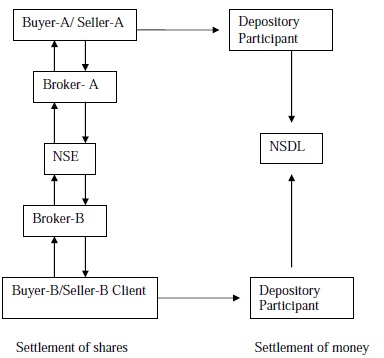

Buyer-B of Broker-B purchases 100 shares Reliance from Broker-A at the same time Seller-A sells 100 shares of Reliance to Broker B through Broker-A then following procedure take place B pays to broker-B the amount due on the shares purchased by him.

Broker-B pays the settlement amount to NSE (Funds Pay in) NSE pays the amount to the Seller Broker-A Then Seller Broker-A pays the amount to seller-A (Funds Pay out) Simultaneously Seller-A delivers 100 Reliance to Broker-A in his depository account (Shares Pay in)

Broker-A delivers the shares to NSDL through his Depository Participant. NSDL then gives the shares to broker-b Finally Broker-B delivers the shares to Buyer-B (Shares Payout)

An investor who wants to hold his securities in electronic form he has to approach a Depository Participant and through him open an account at NSDL. After getting Client I.D. no. from NSDL then client goes to a registered broker of NSE/BSE for investing in the shares. The client gives the order to the operator seating on the NEAT software (National Exchange for Automated Trading) for particular scrip at a specific price when the bid matches on the screen the confirmation tag blinks with the scrip ISIN no.(International Securities Identification Number) for which he has to take the delivery and make the payment on T+2 basis, if he doesn t make the payment it goes to Auction and he has to pay the penalty and the auction price for the shares traded.

1. Website of RBI, SEBI and NSE.

2. Financial Management Module of ICFAI.

3. C.S. Module (for few definitions)

4. The Economic Times (newspaper)

5. Book Reference

a. Indian Financial System

b. Advance Financial System

6. Discussion with the senior staff of PSE.