Published on Feb 28, 2025

Each investment alternative has its own strengths and weaknesses. Some options seek to achieve superior returns (like equity), but with corresponding higher risk. Other provide safety (like PPF) but at the expense of liquidity and growth.

Other options such as FDs offer safety and liquidity, but at the cost of return. Mutual funds seek to combine the advantages of investing in arch of these alternatives while dispensing with the shortcomings. Indian stock market is semi-efficient by nature and, is considered as one of the most respected stock markets, where information is quickly and widely disseminated, thereby allowing each security’s price to adjust rapidly in an unbiased manner to new information so that, it reflects the nearest investment value. And mainly after the introduction of electronic trading system, the information flow has become much faster. But sometimes, in developing countries like India, sentiments play major role in price movements, or say, fluctuations, where investors find it difficult to predict the future with certainty.

Some of the events affect economy as a whole, while some events are sector specific. Even in one particular sector, some companies or major market player are more sensitive to the event. So, the new investors taking exposure in the market should be well aware about the maximum potential loss, i.e. Value at risk.

An analysis of securities and the organization and operation of their markets. The determination of the risk reward structure of equity and debt securities and their valuation. Special emphasis on common stocks. Other topics include options, mutual fluids and technical analysis. Technical analysis is a method of predicting price movements and future market trends by studying charts of past market action which take into account price of instruments, volume of trading and, where applicable, open interest in the instruments.

Fundamental analysis is a method of forecasting the future price movements of a financial instrument based on economic, political, environmental and other relevant factors and statistics that will affect the basic supply and demand of whatever underlies the financial instrument. Objective of the Project

The objectives of carrying out study are as follows:-

1. To do equity analysis of chosen securities

a) To justify the current investment in the chosen securities.

b) To understand the movement and performance of stocks.

c) To recommend increase/decrease of investment in a particular security.

The research has been based on secondary data analysis. The study has been exploratory as it aims at examining the secondary data for analyzing the previous researches that have been done in the area of technical and fundamental analysis of stocks. The knowledge thus gained from this preliminary study forms the basis for the further detailed Descriptive research. In the exploratory study, the various technical indicators that are important for analyzing stock were actually identified and important ones short listed.

The sample of the stocks for the purpose of collecting secondary data has been selected on the basis of Random Sampling . The stocks are chosen in an unbiased manner and each stock is chosen independent of the other stocks chosen. The stocks are chosen from the Banking Sector .

The sample size for the number of stocks is taken as 3 for technical analysis and fundamental analysis of stocks as fundamental analysis is very exhaustive and requires detailed study.

The ideas of Charles Dow, the first editor of the Wall Street Journal, form the basis of technical analysis. The Dow theory is a method of interpreting and signaling changes in the stock market direction based on the monitoring of the Dow Jones Industrial and Transportation Averages. Dow created the Industrial Average, of top blue chip stocks, and a second average of top railroad stocks (now the Transport Average). He believed that the behavior of the averages reflected the hopes and fears of the entire market. The behavior patterns that he observed apply to markets throughout the world.

Markets fluctuate in more than one time frame at the same time:

Nothing is more certain than that the market has three well defined movements which fit into each other.

The first is the daily variation due to local causes and the balance of buying and selling at that particular time.

The secondary movement covers a period ranging from ten days to sixty days, averaging probably between thirty and forty days.

The third move is the great swing covering from four to six years.

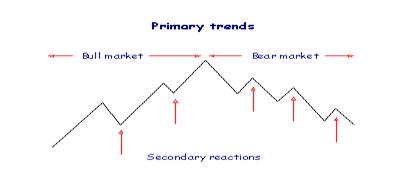

Bull markets are broad upward movements of the market that may last several years, interrupted by secondary reactions. Bear markets are long declines interrupted by secondary rallies. These movements are referred to as the primary trend.

Secondary movements normally retrace from one third to two thirds of the primary trend since the previous secondary movement.

Daily fluctuations are important for short-term trading, but are unimportant in analysis of broad market movements.

Various cycles have subsequently been identified within these broad categories.

www.moneycontrol.com

www.myiris.com

www.indiaearnings.moneycontrol.com

www.investopedia.com